On 20 April 2024, the 840,000th block was created, marking the completion of Bitcoin's fourth halving. It's a milestone that, as a pioneer in the cryptocurrency space, has held the nerves of investors and market analysts across the globe with each halving of Bitcoin.

Since Bitcoin's inception in 2009, the mining reward has been reduced from the original 50 bitcoins per block to 3.125 today, going through four halving cycles. The halving mechanism is a core component of Bitcoin, designed to control its supply by reducing the mining reward, thereby safeguarding its scarcity and value. The mechanism is automatically triggered every four years, halving the number of newly generated bitcoins until the total reaches 21 million.

Prior to this halving, bitcoin miners were rewarded with 6.25 bitcoins for every block they successfully mined; after the halving, this number dropped to 3.125. This change not only reduces the rate at which new bitcoins are issued, but also effectively curbs the potential risk of inflation. History has shown that each halving has significantly increased the market value of Bitcoin, as the reduction in supply has driven the price up while demand has remained constant.

According to urrent expectations, the next halving will occur in February 2028, when the block height will reach 1,050,000. however, this point in time is not fixed and depends on the actual rate of block mining, which may fluctuate in practice despite the mining algorithms setting a target block-out time of 10 minutes. The Bitcoin Halving Mechanism will continue to play its central role in ensuring that Bitcoin's status as a scarce asset is further cemented.

Recall that the last round of halved crypto bulls was a dollar deflation bull.

Facing the sharp decline in the U.S. economy and rising unemployment caused by the new coronavirus epidemic,The Federal Reserve took decisive action. First, it cut the lower limit of the federal funds rate to zero sharply for two consecutive times to stimulate economic activity. Second, the Fed also announced unlimited purchases of Treasury bonds and mortgage-backed securities (MBS) to support economic recovery by increasing liquidity in the market. This series of monetary policy initiatives, known as quantitative easing, was designed to lower long-term interest rates and encourage banks to increase lending to the real economy through large-scale purchases of financial assets.

This monetary 'watering down' initiative has had a significant impact on the size of the Federal Reserve's balance sheet. In just 26 months, its size expanded from $4.2 trillion at the end of January 2020 to $9 trillion at the end of March 2022, an increase of $4.8 trillion, a rate of expansion far greater than that during the 2008 subprime credit crisis. Of even greater concern is the fact that prices, a key macroeconomic indicator, showed a very different trend after these two monetary easing policies. At the same time, the Russian-Ukrainian conflict led to a rapid escalation in global energy and food prices, further exacerbating volatility in the global economy.

Against this backdrop, hot dollar money began to flow into various markets around the world, with Bitcoin becoming a key investment target. 2020 saw Bitcoin rise by more than 300 per cent, with a nearly 50 per cent increase in December alone. Entering 2021, Bitcoin soared even more than 120 per cent, hitting a then-high of nearly $65,000 in mid-April in a roller-coaster ride.

Meanwhile, U.S. cryptocurrency trading platform Coinbase successfully went public in April, with a first-day listing valued at $86 billion, making it the largest cryptocurrency company to go public in trading to date. However, market volatility has also been a constant companion to Bitcoin. in May, the price suffered a 35 per cent slump, only to soar to a new all-time high of $69,000 in November. This series of events demonstrates the complexity and uncertainty of the Bitcoin market.

Why is this halving an opportunity for the development of the Bitcoin ecosystem?

Halving has always been a challenge to the income of Bitcoin miners. If the income of miners is not enough to cover the costs, then the security of Bitcoin will be subject to significant opportunities. The rise and fall of a single currency's price is affected by many factors and cannot effectively combat inflation. Therefore, this halving has also attracted much attention, but since last year, the Bitcoin transaction scene has shown a blowout trend, and its ecosystem has also opened new doors of income for miners.

Starting in early 2023, the NFT protocol "Ordinals" created by software engineer Casey Rodarmor will officially debut on the Bitcoin mainnet, injecting new vitality into the entire Bitcoin ecosystem. With the prosperity of the ecosystem and the increase in gas costs, the income of miners has also increased.

It seems that miners are more like the promoters of this round of ecological development. If we talk about the Bitcoin ecosystem, we will find that this is not a very new concept. Many project parties have made many attempts since 2013, from Bitcoin Cash to colored coins, and even to the fork of Bitcoin. These attempts do not seem to have changed the mainstream opinions of the community. But the time for halving has arrived. As key participants in the Bitcoin ecosystem, miners naturally have a strong desire to improve this ecosystem or increase profits by building it. However, in the past, Bitcoin’s infrastructure was not strong enough to support functions other than mining and transfers. Fortunately, the 2021 Taproot upgrade has greatly improved the scalability and variability of Bitcoin, providing possibilities for its innovation and applications. The birth of Ordinals and the emergence of new technologies such as PBST and MAST are all the fruits of Taproot's upgrade. At the same time, this has also given rise to the development of solutions, such as RGB, stacks, lightning network and BITVM, these second-layer and side chains, which are expected and actively promoted by miners.

Specific examples better illustrate the active participation of miners. Mining giant Marathon Digital has launched its own Bitcoin Layer 2 network, which fully demonstrates the contribution of miners to the development of the ecosystem. In addition, currently well-known Layer 2 projects, such as Merlin, BEVM and BSquared, have received strong support from miners, and the TVL of these projects has therefore achieved rapid growth. This is not only because miners have a large number of idle Bitcoins, but also because they hope to build an infrastructure in the Bitcoin ecosystem that is comparable to Ethereum Layer 2.

Judging from the on-chain data, despite the downturn in the overall encryption market, the transaction volume on Bitcoin has been extremely active since April, and gas fees have continued to rise. This indicates that after two low periods, the third wave of Bitcoin ecology is coming.

During this wave of ecological craze, the community began to realize that the Bitcoin ecosystem still needed richer and advanced infrastructure. In order to meet the growing demand, the Bitcoin ecosystem began to realize the template role of Ethereum, including the Bitcoin currency issuance protocol, Layer 2, Bitcoin DeFi and Bitcoin cross-chain technology, which jointly built the BTCFi ecosystem.

With the hot hype of the token protocol in the Bitcoin network, and more importantly, the development of smart contracts such as more Layer 2 solutions and DeFi application ecology, miners can earn gas fees and maintenance fees. This not only opens up new sources of income for miners, but also promotes further optimization and feature expansion of the Bitcoin network.

Token protocols have also become the main force in this wave of ecological development. As the "singularity" of the "Big Explosion" of the Bitcoin ecosystem, the influence of the token protocol is unparalleled. Recently, the Runes protocol, a brother protocol of the Ordinals protocol, which is specifically used to issue coins, has a strong consensus foundation. As this consensus continues to strengthen, the increase in asset value has become a general consensus in the market.

In the Bitcoin ecosystem, especially in the early "gold mining" stage, issuing inscriptions or runes often means that the profit potential can be greatly increased. However, for most ordinary users, the cost of issuing tokens on the BTC chain is too high and the operation is complicated. Therefore, few smart contract projects can use the tokens of the BTC network.

The Bitcoin main chain mainly serves as a store of value and is difficult to undergo major updates or iterations. Its core function is to ensure decentralization and relative stability. On this basis, many innovative attempts are also being made that gradually emerge from the bottom. In the past year or so, we have also seen many interesting attempts emerging from the bottom up. In the end, everyone found that it is still difficult to innovate on the first layer of Bitcoin. Due to the unique mechanism of Bitcoin, there are currently no tokens with smart contracts.

Opportunities for Bitroot – Programmable Smart Contract Tokens and NFTs

Now we are in such a state: with the accumulation of a large number of assets on Bitcoin, these assets have urgent needs to obtain income and interest. In the past, they were unable to meet these needs for a long time. These hot tokens suddenly emerged. Everyone will test and try out currency projects.

Even if early participants in the community don't like the changes in Bitcoin, they can't stop these developments, which is the beauty of decentralized networks. This kind of network naturally generates many market needs and innovative ways of playing, even if these innovations may seem unwieldy in the early stages.

Back to the essence of the matter, the community’s demand for hot spots cannot always be a hot spot for speculation. Diverse products and functional tokens like Ethereum are what the current Bitcoin ecosystem needs.

Bitroot provides a unique way to achieve decentralized asset issuance and management on the Bitcoin chain. It allows users to create, buy and sell unique digital assets such as art and collectibles on the Bitcoin blockchain. This feature is similar to NFT issuance on Ethereum, but takes advantage of the security and decentralization features of Bitcoin. The functionality of Bitroot is not limited to digital collectibles or tokens, but any item with scarcity, even physical items, can be represented through Bitroot. At the same time, Bitroot supports the issuance of homogeneous tokens with smart contracts. Allows users to issue their own tokens, with a variety of different properties and uses. These tokens can represent assets, equity, notes, etc.

Dividend Tokens: Supports the creation of dividend tokens, and holders can obtain income or dividends, such as dividends or interest, by holding tokens.

Asset tokens: Support the creation of asset tokens, representing certain assets or interests, such as gold, stocks, real estate, etc.

Asset-Locked Tokens: Allows the creation of tokens that lock assets, and these tokens can only be unlocked and used under certain conditions, such as being unlocked after a certain period of time, or after certain conditions are met.

Currency tokens: Supports the creation of currency tokens, representing specific currencies, such as US dollars, euros, Bitcoin, etc.

Pre-saletokens: Allows the creation of pre-sale tokens for pre-sale and fundraising activities of the project.

Bitroot is considered a "second layer" solution for Bitcoin that is built on top of Bitcoin, thereby inheriting the security of the original blockchain while providing additional functionality. This includes multi-signature addresses, governance and voting mechanisms, and decentralized exchanges (DEX). These features allow Bitroot to not only be used to issue and trade unique assets, but also support more complex operations such as team collaboration and asset allocation.

Tokens with smart contracts have always been a difficulty and a focus in the development of the Bitcoin ecosystem. As a breakthrough, this may push the Bitcoin ecosystem a big step forward. This is the significance of Bitroot, the programmable currency issuance protocol.

Bitroot’s technical build

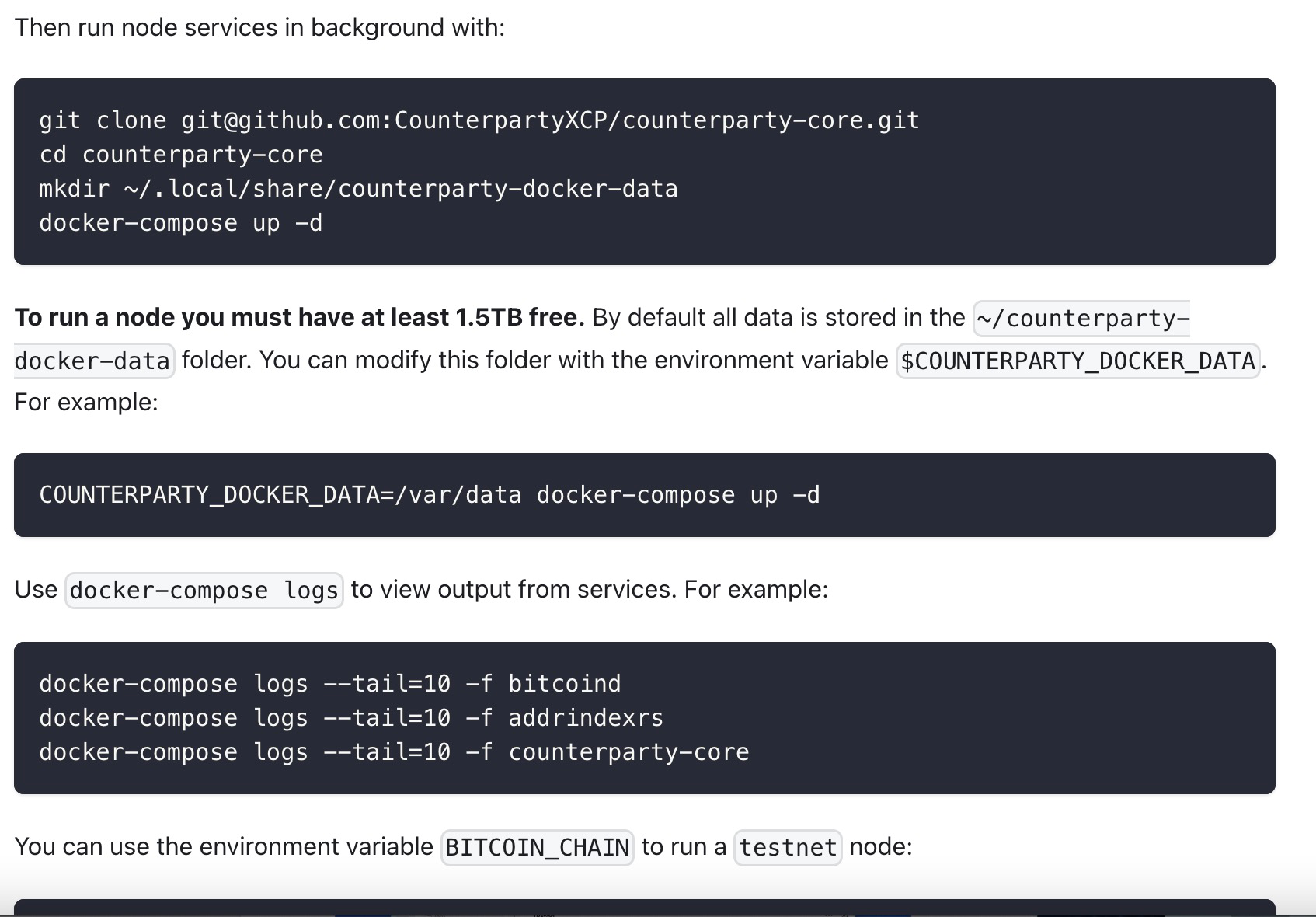

Due to the technical specificity of Bitcoin itself, smart contracts cannot currently be implemented on the Bitcoin network. In order to issue programmable homogeneous tokens and NFTs, Bitroot adopts the extension protocol of the Bitcoin protocol Counterparty Protocol, which implements Bitcoin Many features that are not provided natively. These include token issuance, fully decentralized and trustless asset exchanges, CFDs, native oracles and trustless gaming.

The way counterparties work is by “writing in the blanks” of a Bitcoin transaction, all counterparties are Bitcoin transactions with additional data that the counterparty software can read and interpret. To a regular Bitcoin customer, these transactions will look like regular Bitcoin transactions, with one party sending a very small amount of Bitcoin to another party. Counterparty nodes (which run Bitcoin clients alongside Counterparty Core) will identify and interpret the data from these Bitcoin transactions according to specific rules. Based on this, build your own counterparty ledger and counterparty network status.

These counterparties exist entirely on Bitcoin, and the vast majority use a data encoding method called OP_RETURN, which is completely "unpredictable." This means that data can be safely discarded by Bitcoin nodes that do not wish to store it. Unpredictable counterparties use alternative encoding methods. However, the outputs of these transactions do not stay in the memory of Bitcoin nodes for very long. Of course, every transaction pays a fair mining fee to the network.

The mission of the Bitroot project and the value proposition of the project

If Ethereum has given a model for ecological development, the Bitcoin ecosystem should be even more worth imagining. Bitroot’s mission is to make the Bitcoin ecosystem prosper and develop, and bring smart tokens into the Bitcoin mainnet. Using Bitroot, developers can program tokens on Bitcoin to adapt to the current default working conditions. By default, tokens issued using Bitroot allow for a variety of distribution scenarios, allowing developers to Bitcoin’s liquidity and users adapt it to their applications.

Let us look back at the many things that emerged on Ethereum in the early days. They were also messy and full of various problems, but in the end there were indeed successful cases. So it will eventually move in the right direction, and the same is true for Bitcoin. We have to observe more and give it enough time and patience to let it develop. There should be some revolutionary new developments. Currently, we are still in the early stages of this process. But the emergence of Bitroot will undoubtedly accelerate the pace of Bitcoin ecological development.

No comments yet