The Certified Management Accountant (CMA) credential is one of the main accounting credentials that could propel you to even greater success and accomplishment. You must pass the CMA exam, fulfill the requirements for education and experience, and be a member of the Institute of Management Accountants (IMA) in order to become a Certified Public Accountant (CPA). If you’re wondering “Why should I become a CMA?” have a look at these four advantages. Find out more about each of them to see how getting certified can help you advance in the accounting industry.

Explore Now : https://mastermindsindia.com/cma-online-classes/

Breaking down the CMA Benefits

1. The CMA opens doors into the business world :

The CMA is an advanced, internationally recognized credential that demonstrates the ability to make financial decisions relating to business. For some, it’s better than a CPA because of the business focus. If you want to help run a business, make business decisions, or be involved in any other aspect of the business world, the CMA is your pass. Accurate comprehension of the intersection of accounting and business allows you to specialize in your accounting profession.

The CMA is designed to integrate accounting procedures with business knowledge, and it is commonly recognized as the gold standard in management accounting. You need to understand corporate governance and concepts like responsibility accounting in order to pass the CMA exam. You are in a unique position between the management and finance divisions of a firm because of this understanding. As a result of their ability to make informed business decisions with financial considerations, CMAs frequently end up advising their clients.

The CMA provides organizations with the essential financial knowledge they need to operate profitably and efficiently. CMAs work closely with upper management and influence the course of these businesses with their knowledge, skills, and experience. When armed with pertinent financial data and analysis, a CMA becomes an invaluable member of the management team.

If you want to be a key player in a firm, one of the most important things you can do as an accountant is to earn your CMA.

2. The CMA advances your career :

You can have an exciting, fulfilling, and successful accounting career by earning your CMA. The CMA sets you apart from other accountants by clearly outlining your goals for your career. It is implied that you plan to manage money rather than just report it when you add the letters “CMA” after your name. Getting through the CMA exam shows that you are motivated to learn more than just what is required for a bachelor’s or master’s degree. 87% of CMAs, according to the IMA, claim that earning their certification increased their ability to work in all facets of business.

The CMA enables many accountants to advance to higher-level positions. CMAs hold the following positions, according to the IMA:

| Staff Accountant | Cost Accountant | Senior Accountant | Controller |

| Budget Analyst | Internal Auditor | Finance Manager | Financial Analyst |

| Chief Financial Officer | Chief Executive Officer | Vice President, Finance | Treasurer |

As you can see, becoming a CMA gives you the ability to not only define your place in the company but also to take a seat at the conference table. A great grasp of both finance and business concepts helps many CMAs advance in their careers.

You will have additional career and promotion prospects if you earn your CMA certification. The need for management accountants is growing along with the need for accountants.

3. The CMA increases your earning potential :

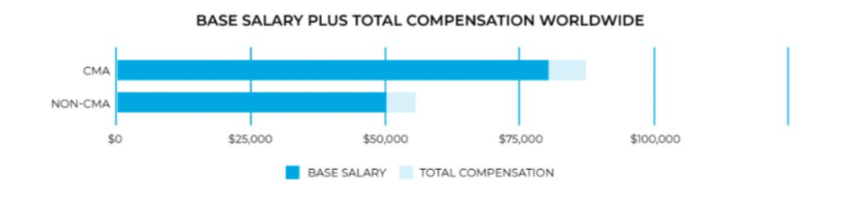

Compared to non-CMAs, CMAs earn greater money. That is all there is to it. Globally, the average income for accountants holding this certificate is 62% higher, or $31,000 more annually. The disparity increases even worse when total compensation—health insurance, retirement, fringe benefits, etc.—is taken into account.

The difference is getting wider. Only 45% more was made by CMAs in 2016 than by non-CMAs. The average income for CMAs in the Americas increased by about $10,000 between 2016 and 2017.

For a variety of reasons, CMAs may make more money than non-CMAs. CMAs are more suited for managerial positions, which are typically where the big money is in the business world, for starters. Second, in order to get qualified, one must have advanced management abilities, which are necessary for positions like chief financial officer or even chief executive officer. People with these skills are in high demand and will fetch a higher salary.

Also Explore : https://mastermindsindia.com/advantages-of-ca-cma-courses/

4. The CMA gives you credibility and status :

Compared to other accountants, CMAs have a deeper comprehension of money and statistics. “CMAs can explain the ‘why’ behind numbers, not just the ‘what,'” claims the IMA. You have to know more about business and accounting than the majority of accountants in order to get the certification. Once you have obtained the CMA, people will come to you for answers to broad, business-related finance queries. Being the go-to expert for help can come with more duties as well as a boost in status and reputation. CMAs identify themselves as an important component of business operations and thrive in the consulting role.

5. Increase financial skills and knowledge :

A lot of accountants who earn the CMA qualification have a strong passion for money and accounting. The two sections of the CMA test include a wide range of topics related to both simple and complex management processes, thus pursuing a CMA requires a firm grasp of both. Gaining proficiency in these crucial skill sets has several advantages for a CMA.

Applying these concepts will provide you transferable skills because obtaining the CMA certificate requires a thorough understanding of management accounting procedures. Generally speaking, a CMA’s duties are more specialized than a general accountant’s. To enhance your professional skills, make sure to include tasks like risk management, critical investment decisions, and budget analysis and planning into your daily routine.

Increasing your professional horizons by accepting more managerial-level positions is one of the other benefits of earning a CMA. For instance, presenting data in an understandable manner for executive boards and other important business executives is a task that many CMAs handle. These are tasks that most CPAs and entry-level accountants will not undertake. In addition to contributing to larger company objectives, a CMA will probably be expected to examine external trends and numbers—a task usually delegated to upper-level accountants.

One of the numerous advantages of the CMA designation is that it allows you to obtain a better grasp of a company’s financial operations. If you want to learn more about cost accounting and broaden your job horizons, this could be the course for you.

Ready to earn your CMA?

Advancement in the workplace and greater income opportunities are ensured by the CMA certification. You have a strong chance of success because of your background and knowledge. If reaching the top is your goal, there is no limit to your accounting career path. You have an advantage thanks to Masterminds CMA Review, which enables you to travel as quickly, easily, and worry-free as possible.

Also Read : https://mastermindsindia.com/cma-online-classes/

Why Masterminds for CMA?

Go no farther than Masterminds, the best place in Pune for excellent CMA instruction. Masterminds has you covered whether you want the conventional approach of offline meetings or the flexibility of online seminars.

- Proven Track Record: Masterminds has a superb reputation and a group of dedicated educators who consistently deliver exceptional outcomes. Masterminds has established itself as a reliable brand in CMA education thanks to our students’ constant excellence.

- Comprehensive Curriculum: Our painstakingly crafted curriculum guarantees that you will comprehend the CMA syllabus completely. We cover every facet of cost and management accounting, giving you the know-how and abilities you need to succeed in your coursework and beyond.

- Flexible Learning Options: Understanding that every student has different needs, Masterminds offers both in-person and online classes. We provide a customized learning solution, regardless of your preference for the lively atmosphere of a real classroom or the ease of studying from home.

- Expert Faculty: At Masterminds, we think that high-quality education has immense power. Our knowledgeable and devoted instructors are committed to fostering your academic development. They guarantee that you receive the greatest instruction because they bring a lot of expertise and experience from the industry to the classroom.

- Holistic Learning Experience: Masterminds focuses on creating a comprehensive learning environment in addition to textbooks. We give you access to extra materials, practice tests, and individualized support to help you succeed in your CMA journey and gain confidence.

Selecting Masterminds is the wise decision for your CMA education. Join our network of accomplished CMA professionals to start your journey toward a fulfilling career. We are the first step towards your success!

Visit Now : https://mastermindsindia.com/

No comments yet