Investors track the yield (or rates) of treasury bonds for many reasons. The US government pays the results as interest on the loan of money through the sale of the bond. But what does this mean and how do you find information about the results?

Treasury bills are loans to the federal government that mature in terms of between a few days and 52 weeks. A treasury note matures in two to 10 years, and a treasury bond matures in 20 to 30 years.

The 10-year Treasury yield is closely watched as an indicator of increased investor confidence. Because Treasury Bills, Notes, and Bonds are fully backed by the US government, they are considered the safest investment.

key takeaways

- Treasury securities are loans to the federal government. Maturities range from weeks to 30 years.

- Because they are backed by the US government, Treasuries are considered a safer investment compared to stocks.

- Bond prices and yields move in different directions: falling prices intensify yields, and prices lift lower yields.

- The 10-year yield is used as a proxy for mortgage rates. It is also seen as a sign of investor sentiment on the economy.

- Rising yields signal lower demand for Treasuries, leading investors to prefer higher-risk, higher-reward investments. A descending result suggests the opposite.

Why is the 10-year Treasury yield so important?

The importance of the yield on a 10-year Treasury bond rests solely on understanding the return on investment of the security. The 10 year is used as a proxy for many other mportant financial matters, such as mortgage rates.

This bond usually expresses the confidence of investors. The United States Treasury sells bonds by auction and the yields are determined through a bidding process. When confidence is high, 10-year prices fall and yields rise. This happens because investors feel they can get higher-yielding investments elsewhere and don't feel they have to play it safe.

But when confidence is low, bond prices rise and yields fall, because there is more demand for this safe investment. This confidence factor is felt outside of the US as well. Geopolitical scenarios in other countries can affect US government bond prices, as the US is seen as a safe haven for capital. This can drive up the prices of US government bonds as demand increases, thus reducing yields.

The US Department of the Treasury issues four types of debt to finance government spending: Treasury bonds, Treasury bills, Treasury notes, and Treasury inflation-protected securities (TIPS). Each varies based on maturity and coupon payments.

Another factor related to performance is the expiration time. The longer Treasury bonds mature, the higher the rates (or yields) will be because investors demand more pay the longer their money is tied up. Short-term debt generally pays a lower yield than long-term debt, known as the normal yield curve. But sometimes the yield curve can reverse, with shorter maturities paying higher yields.

The 10-year Treasury is an economic indicator. Its result provides information on investor confidence. While historical yield ranges are clearly not wide, any basis point movement is a signal to the market.

Change the result over time

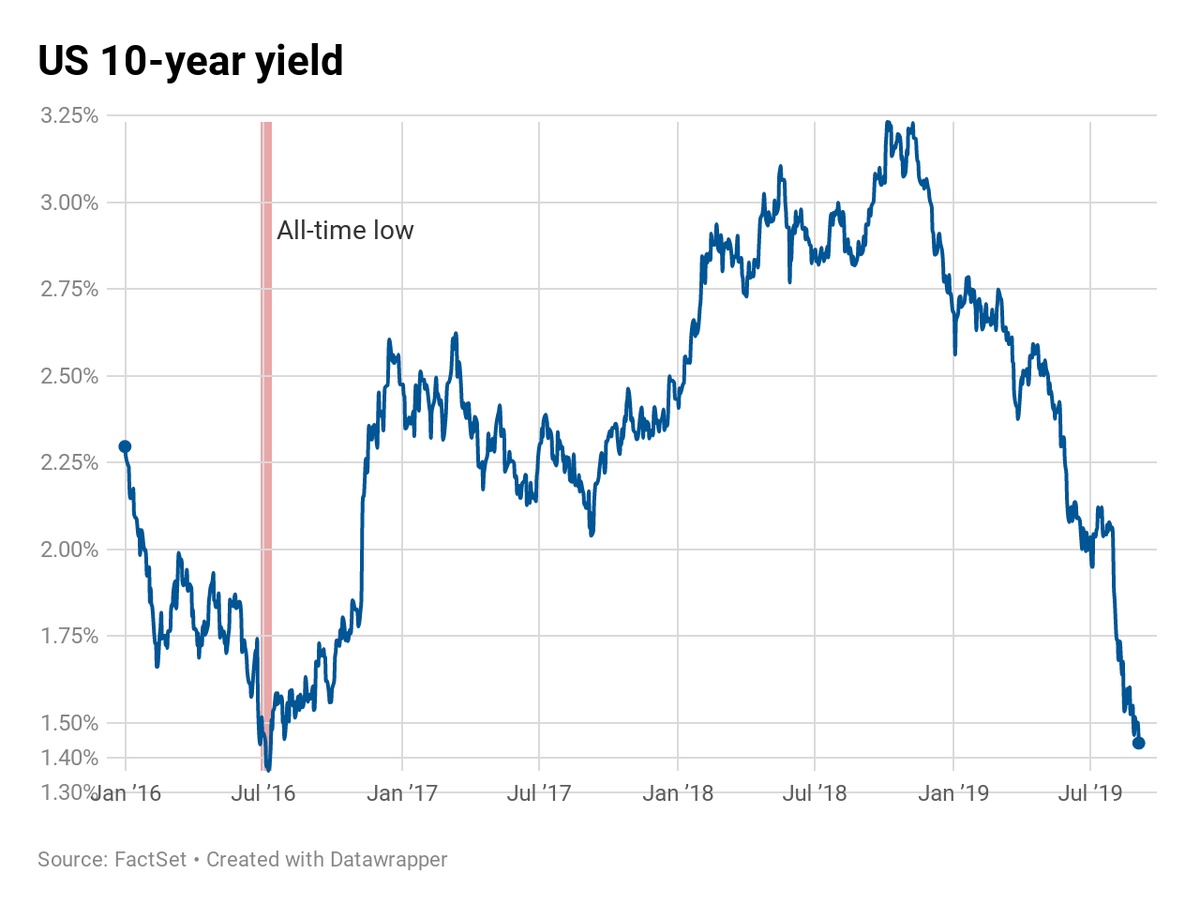

Because 10-year Treasury results are scrutinized in such detail, knowledge of their historical patterns is an integral part of understanding how current yields are paid relative to historical rates. Below is a graph of the results going back ten years.

While the rates do not have a wide range, any change is considered highly significant. Major changes of 100 basis points over time can redefine the economic landscape.

Perhaps the most relevant aspect is to compare current rates with historical rates, or follow the trend to analyze whether short-term rates will rise or fall based on historical patterns. Using the US Treasury website, investors can easily analyze historical 10-year Treasury yields.

No comments yet