When considering car insurance, don't you worry about the "market price" of insurance premiums? Some people may feel that their premiums are higher or lower than those of general car insurance. In this article, in order to deepen your understanding of the market price of insurance premiums, I will introduce "factors that affect insurance premiums" and how insurance premiums are determined. There are two types: face-to-face sales type and non-face-to-face sales type.

How are car insurance premiums determined?

Auto insurance premiums vary greatly depending on several factors, such as the age of the driver, past accident history, and type of car. This is because the frequency of accidents and the degree of damage are different depending on these conditions. Therefore, insurance premiums will vary according to the risk of each individual. Let's take a closer look at the main factors that affect insurance premiums.

age of driver

The age of the driver is one of the major factors that affect the premiums of car insurance. This is because the risk of a car accident changes with the age of the driver. In practice, premium rates are divided according to the age range of the driver and the age group of the named insured.

Historical statistics have shown that younger and older drivers tend to be at higher risk of accidents than other age groups. Specifically, premiums are high for people in their teens and 20s, and low for people in their 30s and 40s. In addition, the age range of drivers is generally divided into three categories as follows: "All age coverage", "21 years old or older coverage", and "26 years old or older coverage" (May differ depending on the insurance company. ), but the insurance premium for "All Ages Coverage" is the highest, and the insurance premium for "26 years old and over coverage" is the lowest.

Although the number of traffic accidents decreases with age, the number of accidents starts to increase from ``60 to 69 years old'', and the risk of ``70 years old and over'' is even higher. In order to reflect these differences in risks between age groups in insurance premiums, when the named insured person is limited to individuals for coverage over the age of 26, six further categories are established according to the age group of the named insured person. increase.

Named insured persons are divided into 6 age groups

Past accident history

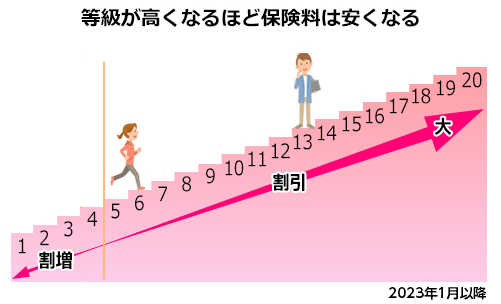

Insurance premiums also vary depending on the past accident history of the policyholder. Insurance premium rates are classified into grades from 1 to 20, as the risk varies depending on the number of accident-free years and the number of accidents in the past.

Grades are categories that determine premium rates and discount rates. Grades 1 to 4 are extra, and grades 5 to 20 are discounted.

Normally, you start from grade 6, and if there are no accidents (or accidents that are not counted) for one year, you will be upgraded by one grade to grade 7. On the other hand, if you cause an accident for which insurance money is paid, in principle, it will be lowered by 1 to 3 grades. The higher the grade, the lower the insurance premium because the risk of an accident is considered to be low.

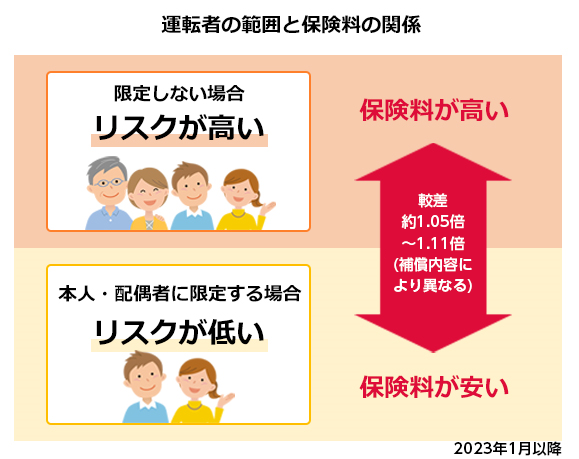

driver range

Risks also vary depending on the range of covered drivers. The more limited the range of drivers, the lower the risk and thus the lower the insurance premiums; the more extensive the range of drivers, the higher the premiums.

(Source) From the General Insurance Rating Organization of Japan “Overview of Automobile Insurance FY2022 (FY2021 Statistics)”

The classification of the scope of the driver differs for each insurance company, but in general, it is “not limited to the driver”, “limited to the named insured person”, “limited to the named insured person and his spouse”, and “named insured person”. You can choose from options such as "Limited to people and their families".

car model

The "model" of a car is the sign code indicated on the vehicle inspection certificate (automobile inspection certificate). Because there is a large difference in risk (the difference between the maximum and minimum values) for each type, premium rates are divided.

The insurance premium rate for a model is calculated based on accident records consisting of bodily injury liability, property damage liability, bodily injury, and vehicle insurance. For private standard and small passenger cars, there are 17 levels from 1 to 17 classes, and for light four-wheeled passenger cars. is categorized into "three levels of 1 to 3 classes" premiums. Depending on the model, one of these classes is applied, but the higher the number, the higher the risk, so the premium will be higher. For example, luxury cars, which tend to be expensive to repair, tend to be classified into higher model rate classes.

Uses and types of automobiles

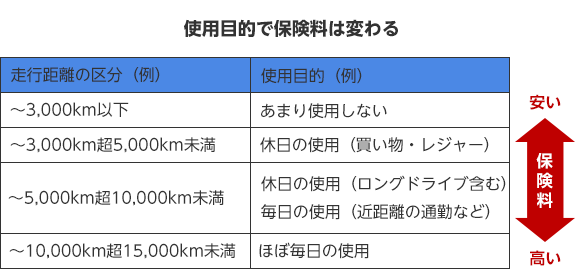

Insurance premiums vary depending on whether the car is for personal use or for business. This is because the risk of causing an accident changes depending on whether the mileage is large or small.

Specifically, the insurance premium rate is divided by purpose and vehicle type, as risks differ depending on the purpose of using the vehicle (private use, business use, etc.) and the type of vehicle (passenger/freight, ordinary/compact/light, etc.). I'm here.

*The table above is a guideline only. Mileage limits vary by insurance company.

The mileage is applied based on the actual annual mileage, but in the case of a new contract, the application may be based on the expected mileage.

Presence or absence of safety device

Some car insurance companies offer lower premiums for cars equipped with safety devices. This is because vehicles with safety devices are considered to be less risky than vehicles without safety devices.

Collision Mitigation Braking (AEB), which automatically detects obstacles in front of the car and helps avoid collisions, is a safety device with a lower insurance premium. There is an "immobilizer" that prevents such things as.

Insured amount and deductible amount

The insurance amount and deductible amount set at the time of contract also affect the premium of car insurance. As a general rule, the higher the sum insured, the higher the premium. Also, the higher the deductible, the lower the premium. By setting a high deductible, the insurance company is less likely to pay the claim amount. The deductible is the amount that the policyholder pays out of pocket in the event of an insured event.

number of cars owned

If you own more than one car, you may be able to receive a discount on your insurance premiums by purchasing a single car insurance policy.

This is called a "second car discount" and is used by many insurance companies. Specifically, when you sign a contract for a second or subsequent vehicle, if you meet the applicable conditions, you can sign a contract with a grade that is one step higher than usual, and the insurance premium will be cheaper (the applicable conditions vary by insurance company). it's different).

What are the “compensation” and “special contract” that should be attached?

Even if premiums are a concern, there are coverage and riders that should not be cut. The following compensation and special provisions should be included as much as possible.

bodily injury liability insurance

When you are legally liable for damages resulting from the death or injury of another person, insurance claims are paid for the portion that exceeds the amount covered by compulsory automobile liability insurance. If you cause an accident resulting in personal injury, the amount of compensation for damages can be high, so it is generally considered to be a good idea to purchase "unlimited" personal liability insurance.

property damage insurance

If you cause damage to another person's property and are legally liable for damages, the insurance will pay out. If you cause a traffic accident with a commercial vehicle, etc., the amount of compensation for damages may be high, so it is thought that it is better to subscribe to "unlimited" liability insurance.

personal injury insurance

If the named insured or his/her family members are killed or injured in an automobile accident, the amount of damages will be paid as insurance, up to the set insurance amount, regardless of the degree of fault. The point is that the insurance money is paid without waiting for a settlement.

Lawyer's fee rider

This is a special contract that compensates for attorney fees and legal consultation fees incurred to claim damages from the other party of the accident. If you are not at fault for the accident, the insurance company cannot negotiate out of court. It is a special contract that you want to add in preparation for such a case.

How much does car insurance typically cost?

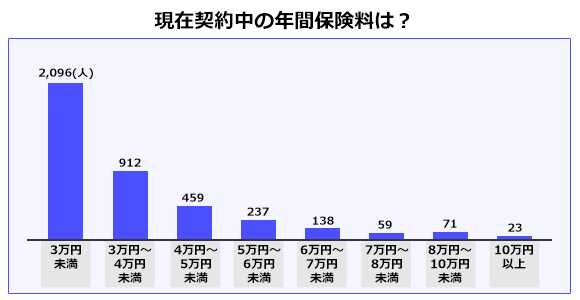

Auto insurance premiums vary depending on various factors, such as the type of vehicle, coverage, and the age of the policyholder, but how much do most people generally pay?

According to the questionnaire survey conducted by “Rakuten Insurance Bulk Estimate”, the results are as follows. According to the results of this survey, more than 80% of the total insurance premiums are less than 50,000 yen per year.

*Eligibility: Those who used the Rakuten Insurance Comprehensive Estimate service between January 1, 2019 and December 31, 2019, and who currently have direct-type automobile insurance ( Optional)

* Survey period: January 27, 2020 to February 14, 2020

*Number of valid responses: 3,955

*Survey conducted by Rakuten, Inc.

How to reduce the burden of insurance premiums?

Here are some tips on how to keep your insurance costs as low as possible.

Join by mail order type (direct type)

Automobile insurance can be roughly divided into two types: face-to-face sales type and non-face-to-face sales type. “Face-to-face sales type” is automobile insurance that is contracted face-to-face with the person in charge of the agent, and “non-face-to-face sales type” is automobile insurance that is contracted after completing the enrollment procedure by yourself, such as by mailing the application form or online.

Non-face-to-face sales type automobile insurance is also called “mail order type” or “direct type”, and is characterized by the fact that you do the enrollment procedure yourself without going through an agent. As a result, insurance premiums can be kept low because the insurance company does not reflect the costs of recruiting, such as commissions paid to agents, in the premium. If you want to keep your car insurance premiums as low as possible, you should choose a direct type car insurance.

However, there are merits and demerits for both face-to-face and mail-order (direct) types, so it is necessary to check carefully before making a choice.

Set driver restrictions/driver age conditions correctly

It is also important to set the driver limitation and driver age conditions correctly to reduce the burden of insurance premiums. It can be said that it is a point that you want to check not only when you sign up for a new car insurance, but also when reviewing your car insurance. In both cases, the narrower the scope of coverage, the lower the premium.

Compare and choose car insurance

Comparing multiple auto insurance policies is also a great way to save money on insurance premiums. Even if the conditions are the same, different insurance companies will quote different amounts. Some auto insurance policies also offer lower premiums under certain conditions, such as setting lower premiums for drivers with gold licenses. It's important to compare different car insurance policies and choose the one that's right for you.

No comments yet