Day trading signals are indicators needed to help investors like you and me buy and sell stocks quickly. They are necessary since they offer valuable information and insights into market trends and potential opportunities.

You must analyze the factors like price movements, volume and technical indicators. Day signals are needed to help investors note the best spot for the entry and exit points.

The signals are needed to reduce the risks for the investors and maximize their profits. Investors can make more combined decisions and avoid impulsive trading depending on emotions and speculations. An investor will buy a stock at a low price when the signal indicates an upscale in the price.

Investors can save time and effort analyzing the market data. Investors need to notice the signal changes and opt to enter and exit the market whenever needed. Investors can focus on other marketing and trading strategies like risk management and portfolio diversification.

Different types of day trading signals.

The different types of day signals are stated below:

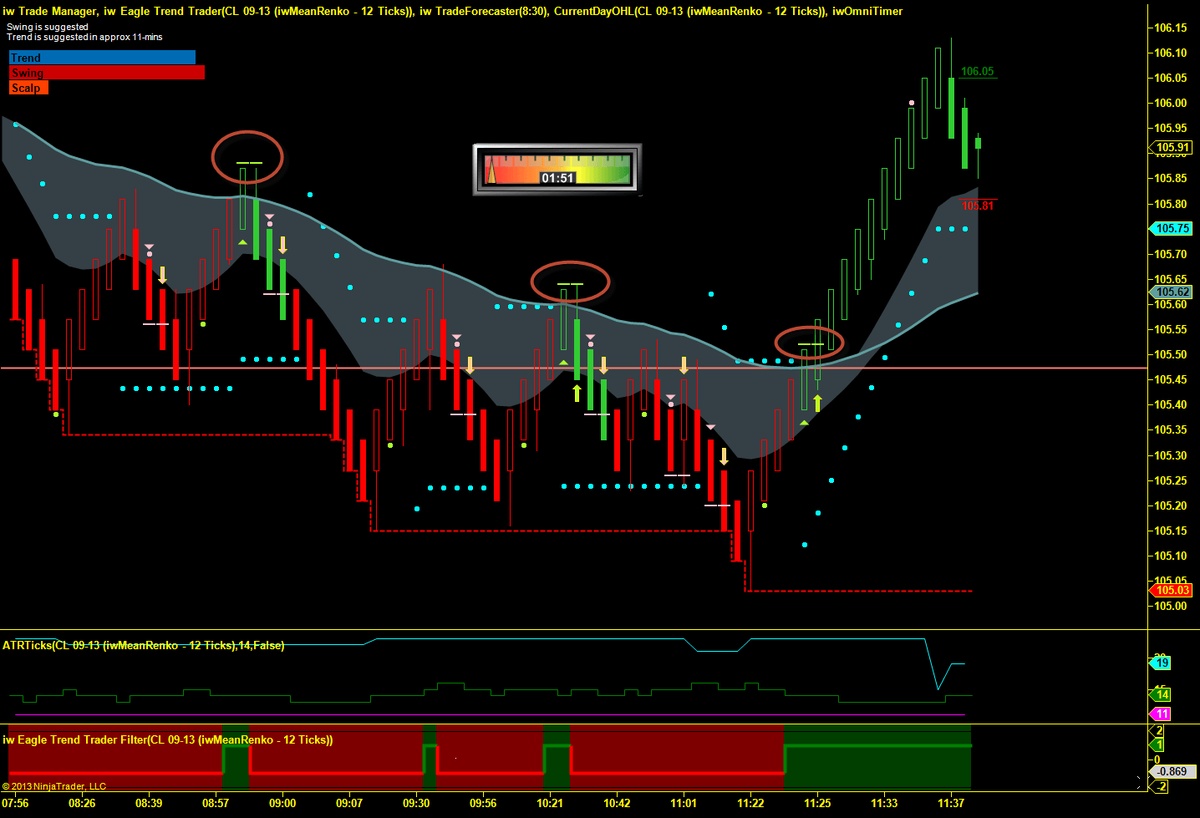

- Technical indicators are mathematical evaluations based on historical price and volume data. The indicators are needed to know the trends, momentum and potential entry and exit points.

- News-based signals include monitoring news releases and events, which plays a major role in the financial markets. Several traders depend on sentiment analysis which covers the entire market with the help of social media, news sentiment, and other sentiment indicators.

Common mistakes to avoid when using day trading signals.

Some of the common mistakes in using day trading signals are marked below:

- You should not completely rely on the signals without noticing facts like market trends and news events. Depending on the signals, you must have the proper plan to enter and exit the trades. Traders can boost their chance of success if they are well aware of the signals with the help of other analysis techniques.

- You must pay attention to the challenges of the signals. They provide valuable insights, are not foolproof, and should not be relied upon. You must consider other elements like market conditions, economic indicators, and news events.

Strategies for maximizing profits with day trading signals.

Some of the strategies to maximize the profits with day trading signals are marked below:

- Proper research is mandatory before selecting the best source of the signals. You must select a provider with a good track record and positive user reviews.

- You need to set goals and stick to the predetermined plan. The signals provide valuable insights and execute the trades effectively.

- You need to manage the risk. Day trading is unpredictable, and you must have a risk management strategy. This comes up as stopping loss orders to limit potential losses.

Last Words

Day trading signals are essential for investors as they offer valuable information and insights about market trends and potential opportunities. Investors notice these signals to reduce risks, maximize profits, and save time in analyzing market data. Investors need to evaluate and understand the reliability and accuracy of the signals before using them in their trading strategy. Reach out to Ninza for noticing their trading signals.

No comments yet