Introduction to Virtual Credit Cards

In today's digital age, online transactions have become an integral part of our daily lives. With the surge in e-commerce and online banking, the need for secure payment methods has never been more critical. Enter virtual credit cards, a innovative solution designed to offer enhanced security and convenience for online transactions.

What Are Virtual Credit Cards?

Virtual credit card, also known as disposable or temporary credit cards, are digital versions of traditional credit cards. Unlike physical credit cards, which are made of plastic and have a fixed card number, virtual credit cards are generated electronically and come with a unique set of credentials for each transaction.

How Do Virtual Credit Cards Work?

Generation Process: When a user decides to make an online purchase using a virtual credit card, they can generate a unique card number, expiration date, and security code through their bank or a third-party provider. This information is typically valid for a single transaction or a short period, adding an extra layer of security.

Usage Process: Once generated, the virtual credit card details can be entered just like those of a traditional credit card during the checkout process on a website. After the transaction is completed, the card details become invalid, making it impossible for hackers or fraudsters to reuse them.

Advantages of Virtual Credit Cards

Enhanced Security: One of the primary advantages of virtual credit cards is their enhanced security features. Since each transaction is associated with a unique set of credentials, the risk of unauthorized access or fraudulent activities is significantly reduced.

Convenience: Virtual credit cards offer unparalleled convenience for online shoppers. Users can generate a new card number for each transaction without having to carry multiple physical cards or worry about their personal information being compromised.

Budget Control: Another benefit of virtual credit cards is the ability to set spending limits and expiration dates for each card. This feature enables users to better manage their finances and prevent overspending.

Disadvantages of Virtual Credit Cards

Limited Acceptance: While virtual credit cards are widely accepted by most online merchants, there are still some websites and vendors that may not support this payment method. Users should always check the accepted payment options before making a purchase.

Temporary Nature: Since virtual credit cards are designed for single-use or short-term use, they are not suitable for recurring payments or subscriptions. Users may need to generate a new card for each transaction, which can be inconvenient for some.

How to Obtain a Virtual Credit Card?

Through Banks: Many banks and financial institutions offer virtual credit card services to their customers as part of their online banking platforms. Users can easily generate virtual cards through their bank's website or mobile app and link them to their existing accounts.

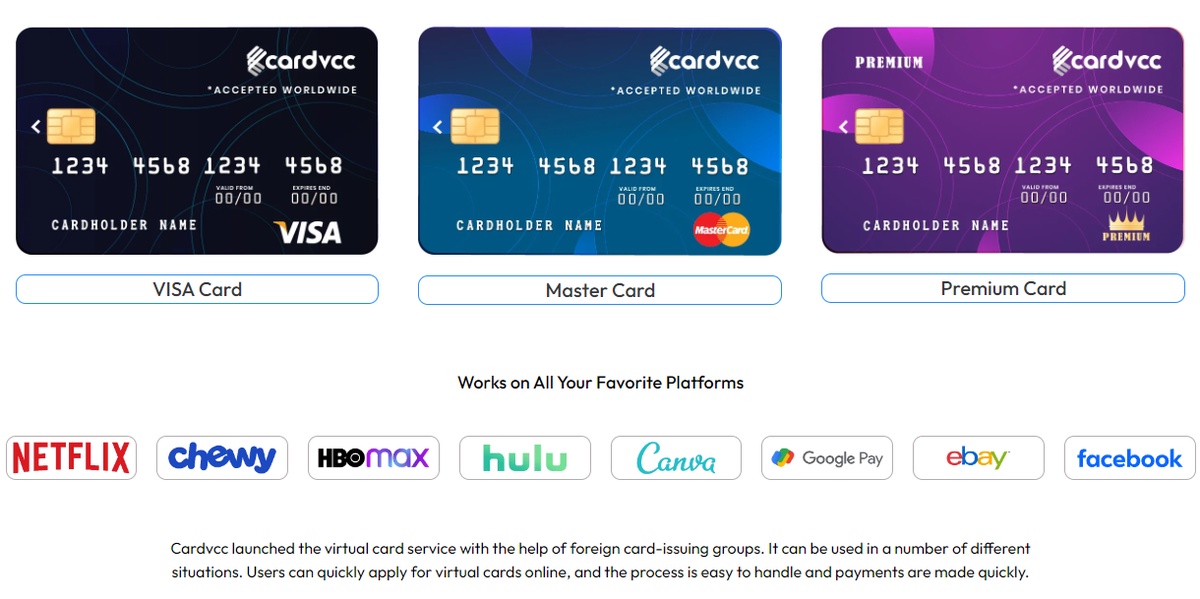

Third-party Providers: In addition to banks, there are also third-party providers that specialize in virtual credit card services. These providers often offer additional features such as advanced security options and compatibility with multiple currencies.

Tips for Using Virtual Credit Cards Safely

- Keep Your Credentials Secure: Store your virtual credit card details in a secure location and avoid sharing them with anyone.

- Monitor Your Transactions: Regularly review your transaction history to detect any unauthorized activity or suspicious charges.

- Use Trusted Platforms: Only use virtual credit cards on reputable websites and platforms that employ encryption and other security measures.

Virtual Credit Cards vs. Traditional Credit Cards

While both virtual and traditional credit cards serve the same purpose of facilitating payments, they differ in terms of security and convenience. Virtual credit cards offer enhanced security features and greater control over spending, making them ideal for online transactions. However, traditional credit cards may still be preferred for in-person purchases and recurring payments.

The Future of Virtual Credit Cards

As online transactions continue to grow in popularity, virtual credit cards are expected to become even more prevalent. Advances in technology and security protocols will likely further enhance the security and convenience of virtual credit cards, making them the preferred choice for digital payments.

Conclusion

Virtual credit cards are a convenient and secure payment solution for online transactions. With their unique set of credentials and enhanced security features, they offer peace of mind for both consumers and merchants alike. While they may not be suitable for every situation, virtual credit cards are undoubtedly a valuable tool in today's digital economy.

FAQs about Virtual Credit Cards

-

Are virtual credit cards accepted everywhere?

- Virtual credit cards are widely accepted by most online merchants, but there may be some exceptions. It's always a good idea to check the accepted payment options before making a purchase.

-

Can virtual credit cards be used for recurring payments?

- Virtual credit cards are typically designed for single-use or short-term use and may not be suitable for recurring payments or subscriptions.

-

How do virtual credit cards enhance security?

- Virtual credit cards generate a unique set of credentials for each transaction, reducing the risk of unauthorized access or fraudulent activities.

-

Can I set spending limits on virtual credit cards?

- Yes, many virtual credit card providers allow users to set spending limits and expiration dates for each card, providing greater control over finances.

-

Are virtual credit cards free to use?

- While some banks may offer virtual credit card services for free to their customers, there may be fees associated with certain features or transactions. It's best to check with your bank or provider for more information.

No comments yet