In today's interconnected world, the dynamics of international trade have evolved, necessitating innovative financial solutions to address the complexities of global commerce. Supply chain finance, vendor financing companies, and factoring in export finance have emerged as key players in facilitating seamless transactions across borders. In this blog, we will delve into these concepts and explore how they contribute to the efficiency and growth of businesses worldwide, with a special focus on the role of Credlix.

Understanding Supply Chain Finance:

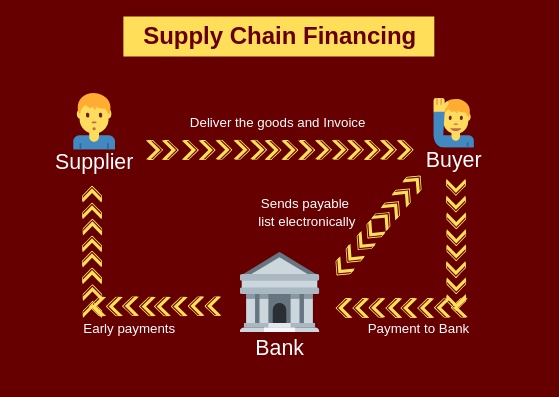

Supply chain finance is a financial strategy that optimizes the cash flow within a supply chain by providing short-term credit to improve the working capital of businesses. This approach enhances the financial health of both buyers and suppliers, fostering collaboration and mutual growth. Through supply chain finance, companies can streamline their payment processes and mitigate the risks associated with delayed payments.

Vendor Financing Companies:

Vendor financing companies play a pivotal role in supporting businesses along the supply chain. These entities specialize in extending credit to suppliers, enabling them to access funds promptly and efficiently. By leveraging vendor financing, suppliers can optimize their cash flow, invest in operations, and meet the demands of their clients without facing financial constraints. This collaborative model creates a win-win situation for both buyers and suppliers, fostering a more resilient and dynamic supply chain ecosystem.

Factoring in Export Finance:

Export finance, particularly factoring, is a crucial component of international trade. Factoring involves a financial institution purchasing a company's accounts receivables at a discounted rate, providing immediate cash flow. This is especially beneficial for businesses engaged in export activities, where payment cycles can be extended due to shipping and customs clearance timelines. Factoring in export finance not only accelerates cash inflows but also mitigates the risks associated with cross-border transactions.

Credlix: Transforming Trade Finance:

One standout player in the realm of supply chain finance and vendor financing is Credlix. Credlix has positioned itself as a leading platform, leveraging technology to revolutionize trade finance. Through its innovative solutions, Credlix connects buyers, suppliers, and financial institutions, creating a seamless and efficient ecosystem for supply chain financing.

Credlix's platform offers real-time visibility into transactions, automates documentation processes, and provides access to a global network of financiers. By utilizing Credlix's services, businesses can optimize their working capital, reduce transaction costs, and enhance the overall efficiency of their supply chain operations.

Benefits of Credlix and Similar Platforms:

-

Efficiency: Credlix streamlines the supply chain finance process, reducing the time and effort required for transaction completion.

-

Transparency: The platform provides transparent and real-time visibility into financial transactions, fostering trust among stakeholders.

-

Global Connectivity: Credlix's extensive network connects businesses with a diverse range of financiers, facilitating international trade with ease.

-

Risk Mitigation: Through its advanced risk assessment tools, Credlix helps businesses identify and mitigate potential risks associated with trade transactions.

Conclusion:

As global trade continues to evolve, the role of supply chain finance, vendor financing companies, and export finance becomes increasingly significant. Businesses that embrace innovative financial solutions like those offered by Credlix gain a competitive edge in the dynamic world of international commerce. By optimizing cash flow, mitigating risks, and fostering collaboration across the supply chain, these financial tools contribute to the growth and sustainability of businesses on a global scale. In essence, the marriage of technology and finance, as exemplified by Credlix, is transforming the landscape of international trade and opening new avenues for businesses to thrive in the global marketplace.

No comments yet