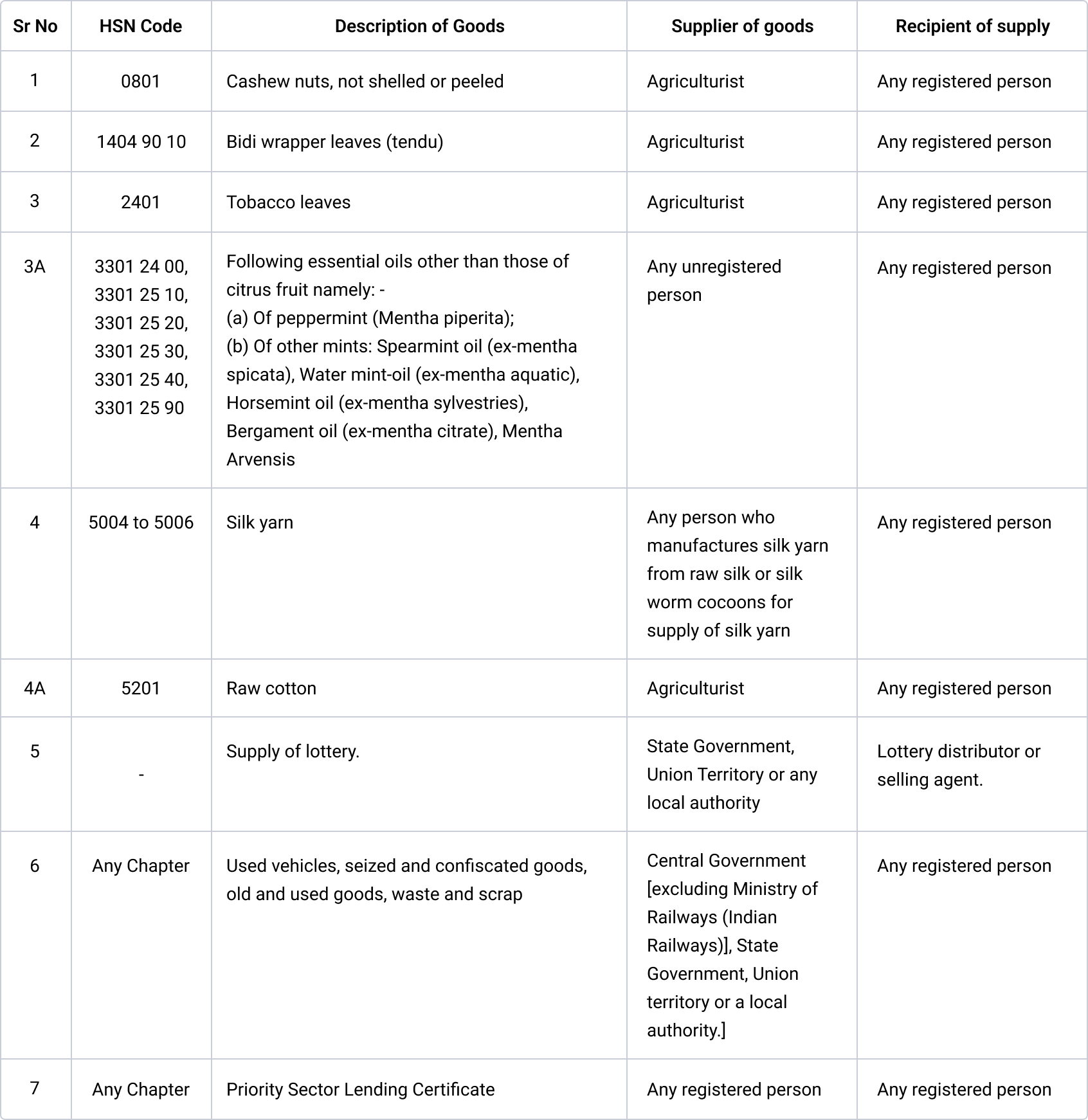

Which are the goods on which RCM is applicable?

As per Notification No. 4/2017 - Central Tax (Rate) and Notification No. 4/2017 - Integrated Tax (Rate), following are the supplies of goods in which case RCM is applicable:

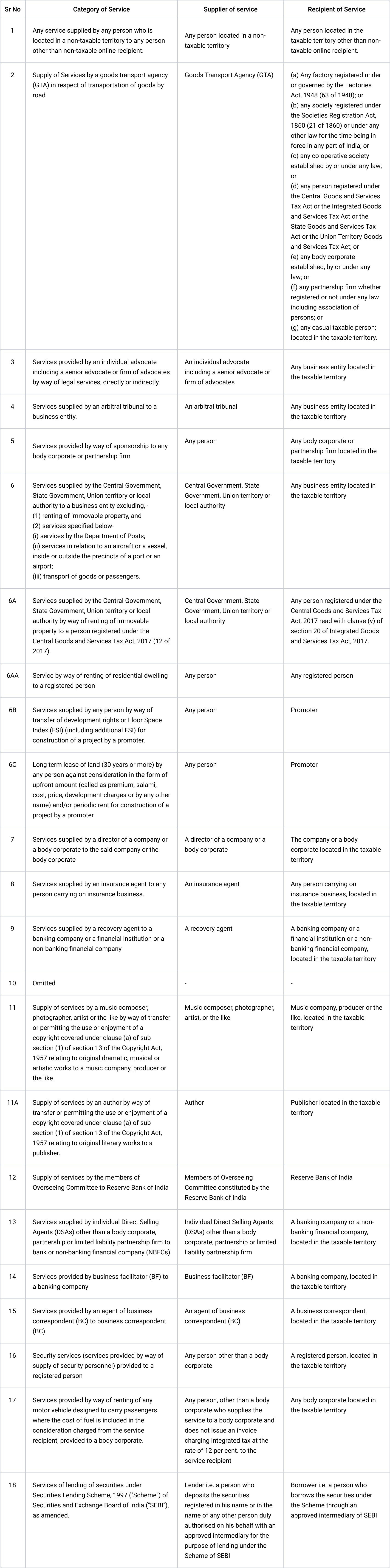

Which are the services on which RCM is applicable?

As per Notification No. 13/2017 - Central Tax (Rate) and Notification No. 10/2017 - Integrated Tax (Rate), following are the services on which RCM is applicable:

Conclusion

In conclusion, the Reverse Charge Mechanism (RCM) under GST applies to specific goods and services as outlined in the notifications provided. It is essential for taxpayers to be aware of these provisions to ensure compliance with GST regulations. By understanding the goods and services covered under RCM, businesses can accurately determine their tax liabilities and fulfill their GST obligations promptly.

No comments yet