Did you know? A growing number of Americans are interested in incorporating cryptocurrency into their retirement plans.

A 2021 survey by Charles Schwab found that 16% of millennial investors are interested in including cryptocurrencies in their IRAs. This trend highlights the increasing demand for investment vehicles that allow exposure to cryptocurrency within a tax-advantaged retirement account.

Bitcoin IRAs provide a unique solution for this growing need. Come, let’s understand what Bitcoin IRA is and how it works.

What is a Bitcoin IRAs?

- A Bitcoin IRA is like a special savings account for retirement where people can invest in Bitcoin and other digital currencies.

- It's a way to spread out their retirement money and have a chance to make more as cryptocurrencies grow.

- By being careful with how they manage their investments and making sure everything is secure,Bitcoin IRAs can help people save up for the future in the fast-changing world of digital money.

|

👉 Also Read: how to buy Bitcoin in India |

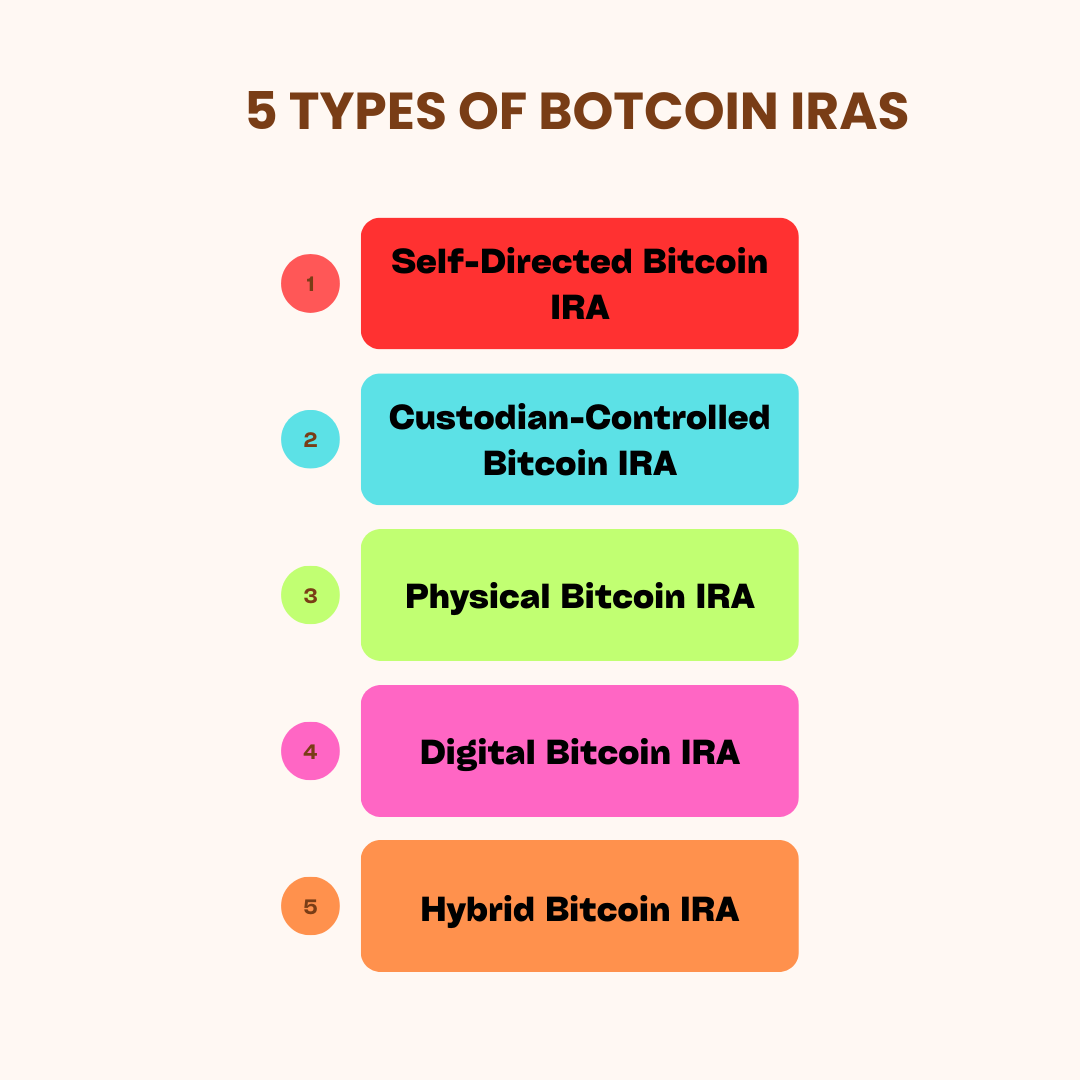

Types of Bitcoin IRAs

Self-Directed Bitcoin IRA

- In this type, investors have full control over their IRA funds and can choose which cryptocurrencies to invest in.

- They can hold various digital assets, like Bitcoin, Ethereum, or others, within their retirement account.

Custodian-Controlled Bitcoin IRA

- With this option, investors rely on a custodian or trustee to manage their Bitcoin IRA.

- The custodian ensures compliance with IRS regulations and often provides secure storage solutions for cryptocurrencies.

Physical Bitcoin IRA

- This type allows investors to hold actual Bitcoin in their retirement accounts.

- They may purchase and store physical Bitcoins or invest in funds backed by physical Bitcoin, offering a tangible representation of their investment.

Digital Bitcoin IRA

- Unlike physical Bitcoin IRAs, digital Bitcoin IRAs involve investing in digital representations of Bitcoin within the retirement account.

- Investors do not hold the actual cryptocurrencies but rather invest in digital certificates or funds that track the value of Bitcoin.

Hybrid Bitcoin IRA

- Combining elements of both self-directed and custodian-controlled IRAs, hybrid Bitcoin IRAs offer flexibility and security.

- Investors can have some control over their investments while still benefiting from professional custodial services for compliance and security.

How Do Bitcoin IRAs work?

- Bitcoin IRAs work by allowing individuals to invest their retirement savings in BTC, potentially benefiting from its growth over time.

- Investors can diversify their portfolios while enjoying the potential for increased value, with the option to convert BTC/INR when needed, offering flexibility and potential long-term wealth accumulation.

Features of Bitcoin IRA

Tax Advantages

- Like traditional IRAs, Bitcoin IRAs offer potential tax benefits, such as tax-deferred growth or tax-free withdrawals in retirement, depending on the type of account (e.g., Roth IRA or Traditional IRA) and local regulations.

Diversification

- Bitcoin IRAs allow investors to diversify their retirement portfolios beyond traditional assets like stocks and bonds, potentially reducing overall investment risk and increasing growth opportunities.

Investment Control

- Depending on the type of Bitcoin IRA chosen, investors may have varying degrees of control over their investments. Self-directed Bitcoin IRAs offer full control, allowing investors to choose which cryptocurrencies to invest in, while custodian-controlled options provide professional oversight and compliance.

Security Measures

- Reputable Bitcoin IRA providers implement robust security measures to safeguard investors' assets, including secure storage solutions, encryption technologies, and compliance with regulatory standards to mitigate risks associated with hacking or fraud.

Potential for Growth

- With the increasing adoption and mainstream acceptance of Bitcoin and other cryptocurrencies, Bitcoin IRAs offer the potential for significant long-term growth, providing investors with exposure to innovative digital assets with high growth potential.

Benefits of Bitcoin IRA Accounts

Bitcoin IRA accounts are good because they help you save on taxes and make more money. You can spread out your retirement savings and invest in digital money, which can grow a lot. It's a safe way to do it, so your money is protected.

|

👉 To get started with IRA, you first need to buy BTC on a global crypto exchange |

Conclusion

In conclusion, Bitcoin IRAs offer a promising avenue for securing your financial future in the digital age. By harnessing the potential of cryptocurrencies like Bitcoin, investors can diversify their retirement portfolios and potentially enjoy significant growth opportunities.

With features such as tax advantages, diversification, investment control, and robust security measures, Bitcoin IRAs provide a safe and innovative way to save for retirement. Whether through a self-directed approach or relying on custodian-controlled options, investors can tailor their Bitcoin IRA to suit their preferences and financial goals.

By leveraging the services of a global cryptocurrency exchange platform like Koinpark or utilizing a cryptocurrency exchange app, individuals can seamlessly manage their Bitcoin IRA investments and navigate the dynamic cryptocurrency market with confidence. Embrace the future of finance and unlock the potential of Bitcoin IRA accounts for a brighter tomorrow.

For more information: How To Buy BTC in India

Trade Now: Buy Bitcoin (BTC) in INR

No comments yet