Introduction

In the present time, with the advancement of technology, everything has been made available in a go; whatever the needs are, now can be brought to our doorstep within minutes. Just the same way, financial institutions have also upgraded their approach towards providing monetary assistance to people who are in need. Now, whatever the emergency is, financial support can be availed within a few clicks just by applying through our mobile phone. In this blog, you will get to know what is a personal loan, how it can be of assistance during financial emergencies and how the services of Rupee112, an NBFC, can be helpful to people living in Ghaziabad, India.

What is a Personal Loan?

A personal loan is a financial tool, a helping hand offered by financial institutions such as banks, credit unions or online lenders that can aid in managing emergency situations easily.

Money is one thing that every one of us is working hard to attain; numerous people in India only make enough that support the needs of their family or their own well-being. Even if an individual is earning well and has been saving, the money is not enough to look over unexpected financial emergencies. Here, availing a personal loan can be of great help as it can be accessed easily with minimum requirements compared to a secured loan.

Rupee112 Personal Loan service in Ghaziabad

Ghaziabad, a city in the Indian state of Uttar Pradesh with a population of 2,358,525, offers a unique blend of metropolitan convenience and suburban allure, providing the people living there with comfort and a vibrant lifestyle. Middle of all the facilities, financial setbacks can develop anytime, and a need for monetary assistance can arise. An instant emergency loan in Ghaziabad from Rupee112 can of great help as it is fast, reliable and convenient. Now, to manage financial emergencies, there is no need to wait in long queues and go through tedious paperwork with Rupee112.

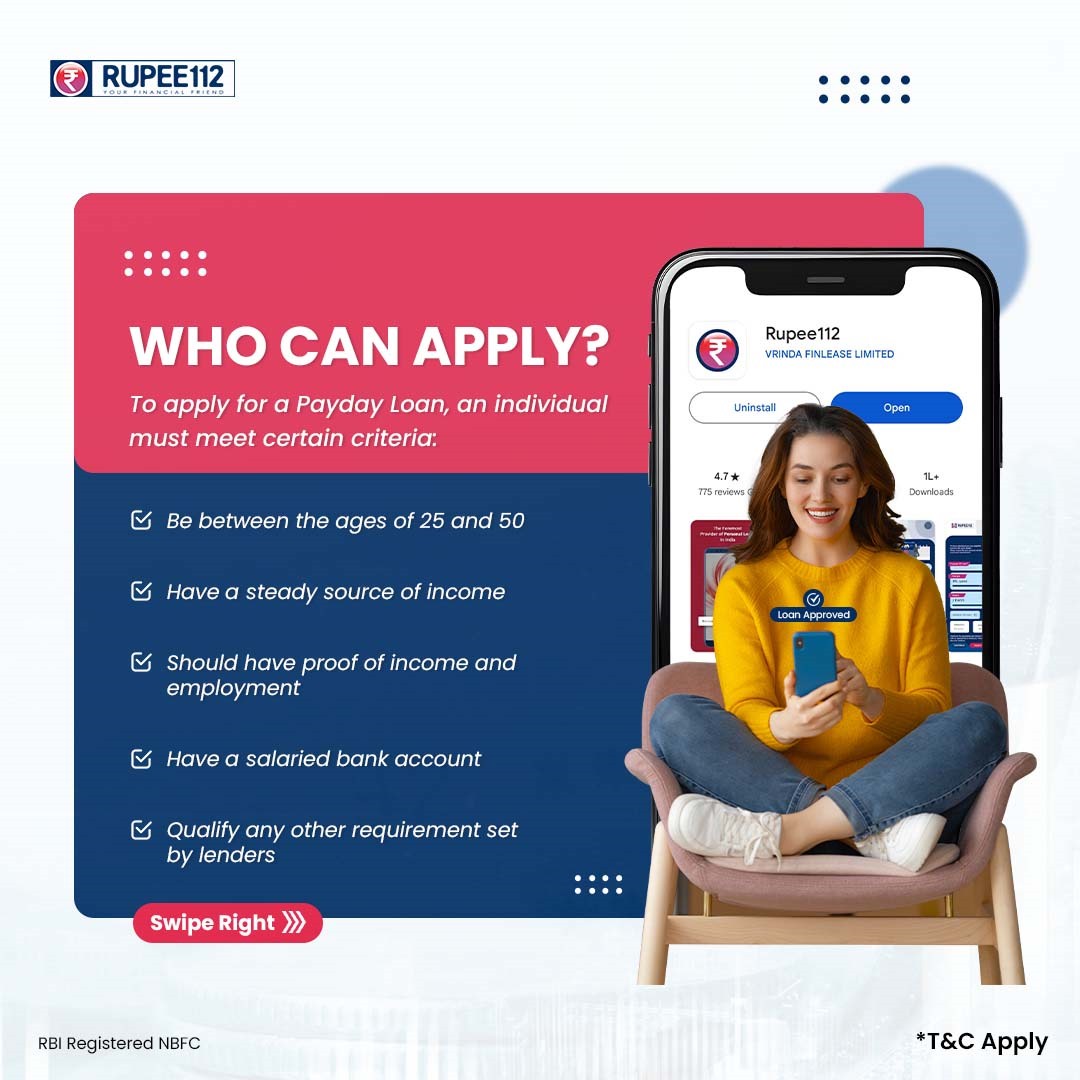

Rupee112 is an NBFC that aims to provide financial assistance to the salaried professionals of India. The primary goal is to offer support during times of financial need, whether it’s for unexpected medical expenses, home renovation or sudden travel plans. Unlike traditional banks that impose strict requirements such as excellent credit score history, Rupee112 aims to break down these barriers to access financial aid without any constraints. We believe in making financial assistance easily accessible to ensure that whoever is in need can quickly obtain financial aid to address their urgent needs.

Rupee112’s emergency personal loan can be easily availed with a seamless online App. All the requirements, from filling in the loan application, uploading the documents, and transferring funds, everything can be done swiftly and conveniently.

Rupee112s Features stand out from the rest!

Instant Approval: When facing emergencies who don’t want quick support, understanding this Rupee112 offers a personal loan with an instant approval process. Our team operates with remarkable efficiency, ensuring swift approvals for loan applications, thereby cutting off waiting time for our valued customers.

30-minute Disbursal: With an instant Loan approval process, Rupee112 also makes sure that any individual who is in need of financial support gets the required funds as soon as possible, aiming to disburse the loan within 30 minutes after all the required steps are completed.

Credit-free Loan: Now, when there is an emergency, and one requires financial assistance, we do not check factors such as healthy credit score as we understand that everyone might not be equipped with that and financial support for emergencies should not have such boundaries; it should to accessible and convenient for the borrowers as much as possible.

100% Online Process: In the present day, no one wants to stand in long queues or go through countless paperwork when availing a personal loan, which is why we have all the processes from applying, documenting, and transferring funds online, making it as easier as ordering food online.

Conclusion

Personal loans being a financial tool, every one of us should understand that it is crucial to research thoroughly before settling and borrowing from a financial institution. Compare the interest rates, assess all costs, avoid falling for false offers and plans, and make sure to find a lender who is transparent about their terms and conditions for the best personal loan experience.

No comments yet